WORLD BANK's GLOBAL ECONOMIC PROSPECTS REPORT

World Bank lowered its global economic growth forecast to 3.3 percent in Global Economic Prospects (GEP) report, from 3.5 in the June report.

After growing by an estimated 2.6 percent in 2014, the global economy is projected to expand by 3 percent this year, 3.3 percent in 2016 and 3.2 percent in 2017, predicts the Bank’s twice-yearly flagship. Developing countries grew by 4.4 percent in 2014 and are expected to edge up to 4.8 percent in 2015, strengthening to 5.3 and 5.4 percent in 2016 and 2017, respectively.

Following another disappointing year in 2014, developing countries should see an uptick in growth this year, boosted in part by soft oil prices, a stronger U.S. economy, continued low global interest rates, and receding domestic headwinds in several large emerging markets, said the World Bank GEP report.

"DEVELOPING COUNTRIES NEED TO UNDERTAKE STRUCTURAL REFORMS"

"In this uncertain economic environment, developing countries need to judiciously deploy their resources to support social programs with a laser-like focus on the poor and undertake structural reforms that invest in people" said World Bank Group President Jim Yong Kim. "It’s also critical for countries to remove any unnecessary roadblocks for private sector investment. The private sector is by far the greatest source of jobs and that can lift hundreds of millions of people out of poverty."

"THE LOWER OIL PRICE IS LOWERING INFLATION WORLDWIDE"

"Worryingly, the stalled recovery in some high-income economies and even some middle-income countries may be a symptom of deeper structural malaise" said Kaushik Basu, World Bank Chief Economist and Senior Vice President. "As population growth has slowed in many countries, the pool of younger workers is smaller, putting strains on productivity. But there are some silver linings behind the clouds. The lower oil price, which is expected to persist through 2015, is lowering inflation worldwide and is likely to delay interest rate hikes in rich countries."

"LOW OIL PRICES PRESENT AN OPPORTUNITY TO UNDERTAKE REFORMS"

Commodity prices were projected to stay soft in 2015, as had been discussed in a chapter in the report, the unusually steep decline in oil prices in the second half of 2014 could significantly reduce inflationary pressures and improve current account and fiscal balances in oil-importing developing countries, said in the statement on the report.

"Lower oil prices will lead to sizeable real income shifts from oil-exporting to oil-importing developing countries. For both exporters and importers, low oil prices present an opportunity to undertake reforms that can increase fiscal resources and help broader environmental objectives" said Ayhan Kose, Director of Development Prospects at the World Bank.

"THE FALL IN OIL PRICES WOULD HELP LOWER INFLATION"

Amongst large middle-income countries that will benefit from lower oil prices is India, where growth was expected to accelerate to 6.4 percent this year, from 5.6 percent in 2014, rising to 7 percent in 2016-17. In Brazil, Indonesia, South Africa and Turkey, the fall in oil prices would help lower inflation and reduce current account deficits, a major source of vulnerability for many of these countries.

"Risks to the global economy are considerable. Countries with relatively more credible policy frameworks and reform-oriented governments will be in a better position to navigate the challenges of 2015" concluded Franziska Ohnsorge, Lead Author of the report.

DHA

DAYAKÇI İMAM SERBEST BIRAKILDI

DAYAKÇI İMAM SERBEST BIRAKILDI LİSEDE İĞRENÇ OLAY

LİSEDE İĞRENÇ OLAY BURSALI, ERDOĞAN'dan ÖZÜR DİLEDİ

BURSALI, ERDOĞAN'dan ÖZÜR DİLEDİ MECLİS'te İSRAİL GERİLİMİ

MECLİS'te İSRAİL GERİLİMİ SEKTÖR YAPI FUARINDA BULUŞUYOR

SEKTÖR YAPI FUARINDA BULUŞUYOR TBMM'de YENİ DÖNEM

TBMM'de YENİ DÖNEM "ASKERİ TESİSLERİ HEDEF ALACAĞIZ"

"ASKERİ TESİSLERİ HEDEF ALACAĞIZ" "ENFLASYONU DÜŞÜRECEĞİZ"

"ENFLASYONU DÜŞÜRECEĞİZ" "DAHA GÜÇLÜ YANIT VERİRİZ"

"DAHA GÜÇLÜ YANIT VERİRİZ" KRİZ YARATACAK İDDİA

KRİZ YARATACAK İDDİA IMF'den TÜRKİYE AÇIKLAMASI

IMF'den TÜRKİYE AÇIKLAMASI İSRAİL KARŞILIK VERME KARARI ALDI

İSRAİL KARŞILIK VERME KARARI ALDI İRAN'a DÜNYADAN TEPKİ YAĞIYOR

İRAN'a DÜNYADAN TEPKİ YAĞIYOR GÖÇ YASASI KABUL EDİLDİ

GÖÇ YASASI KABUL EDİLDİ ABD'den DİKKAT ÇEKEN AÇIKLAMA

ABD'den DİKKAT ÇEKEN AÇIKLAMA İSRAİL TÜRKİYE'yi ŞİKAYET ETTİ

İSRAİL TÜRKİYE'yi ŞİKAYET ETTİ BELÇİKA'da PKK PROVOKASYONU

BELÇİKA'da PKK PROVOKASYONU GAZZE'de ATEŞKES

GAZZE'de ATEŞKES MB FAİZİ YÜZDE 50'YE YÜKSELTTİ

MB FAİZİ YÜZDE 50'YE YÜKSELTTİ 200 TL'nin SATIN ALMA GÜCÜ ERİDİ

200 TL'nin SATIN ALMA GÜCÜ ERİDİ KREDİ KATLARINA DÜZENLEME

KREDİ KATLARINA DÜZENLEME TÜRKİYE NÜFUSU BELLİ OLDU

TÜRKİYE NÜFUSU BELLİ OLDU "EMEKLİ MAAŞ FARKI ÖDEMELERİ BAŞLADI"

"EMEKLİ MAAŞ FARKI ÖDEMELERİ BAŞLADI" YOKSULLUK SINIRI 49 bin TL'yi AŞTI

YOKSULLUK SINIRI 49 bin TL'yi AŞTI SSK ve BAĞ-KUR EMEKLİLERİNE EK ZAM

SSK ve BAĞ-KUR EMEKLİLERİNE EK ZAM EMEKLİYE EK ZAM TEKLİFİ MECLİS'e GELİYOR

EMEKLİYE EK ZAM TEKLİFİ MECLİS'e GELİYOR KİRA DESTEKLERİNDE ARTIŞ

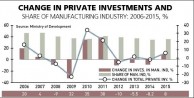

KİRA DESTEKLERİNDE ARTIŞ INDUSTRIAL INVESTMENTS CONTINUE to STAGNATE

INDUSTRIAL INVESTMENTS CONTINUE to STAGNATE THE WORLD's “POOREST” PRESIDENT MUJICA in ISTANBUL

THE WORLD's “POOREST” PRESIDENT MUJICA in ISTANBUL AS WOMEN, WE REFUSE TO BE SILENT!

AS WOMEN, WE REFUSE TO BE SILENT! TURKEY's UNEMPLOYMENT RATE ROSE to 9,8%...

TURKEY's UNEMPLOYMENT RATE ROSE to 9,8%... TURKISH OFFICIAL 'BARKS' AFTER TWEET by 'FAKE GÖKÇEK'

TURKISH OFFICIAL 'BARKS' AFTER TWEET by 'FAKE GÖKÇEK' U.S. AMBASSADOR JOHN BASS HAS HELD a VISIT to HÜRRİYET

U.S. AMBASSADOR JOHN BASS HAS HELD a VISIT to HÜRRİYET HDP COMMITTEE MEETS PKK FIGURES in KANDİL

HDP COMMITTEE MEETS PKK FIGURES in KANDİL TURKEY's UNEMPLOYMENT RATE RISES...

TURKEY's UNEMPLOYMENT RATE RISES... MOVIE to be SHOT in 'DRACULA's CASTLE' in TURKEY

MOVIE to be SHOT in 'DRACULA's CASTLE' in TURKEY KADINLARIN GİZEMLİ DUYGULARI TUALE YANSIDI

KADINLARIN GİZEMLİ DUYGULARI TUALE YANSIDI VAN’da TİYATRO ŞENLİĞİ

VAN’da TİYATRO ŞENLİĞİ NAYİNO

NAYİNO ALBARAKA TÜRK'ten ÖZEL PROJE

ALBARAKA TÜRK'ten ÖZEL PROJE İZMİR'de ÖDÜLLÜ GECE

İZMİR'de ÖDÜLLÜ GECE GÖKTÜRK CAZ FESTİVALİ BAŞLIYOR

GÖKTÜRK CAZ FESTİVALİ BAŞLIYOR İZMİR FİLM FESTİVALİ BAŞLIYOR

İZMİR FİLM FESTİVALİ BAŞLIYOR BİR YILDIZ DOĞUYOR

BİR YILDIZ DOĞUYOR YAZDI, OYNADI, YÖNETTİ

YAZDI, OYNADI, YÖNETTİ ORİON DÜNYA’ya DÖNDÜ

ORİON DÜNYA’ya DÖNDÜ UZAY EĞİTİMLERİ BAŞLADI

UZAY EĞİTİMLERİ BAŞLADI HAVACILAR İSTANBUL’da BULUŞTU

HAVACILAR İSTANBUL’da BULUŞTU BURASI KANDİL DEĞİL, FRANSA...

BURASI KANDİL DEĞİL, FRANSA... OYUN ENDÜSTRİSİ PAZARI BÜYÜYOR

OYUN ENDÜSTRİSİ PAZARI BÜYÜYOR YERLİ 'SWİTCH' GELİYOR

YERLİ 'SWİTCH' GELİYOR İKLİM DEĞİŞİKLİĞİ ARILARI OLUMSUZ ETKİLİYOR

İKLİM DEĞİŞİKLİĞİ ARILARI OLUMSUZ ETKİLİYOR AKADEMİSYENLER BİR ARADA

AKADEMİSYENLER BİR ARADA SEYİR HALİNDEYKEN UYUDU

SEYİR HALİNDEYKEN UYUDU ACİL SERVİS BOŞALTILDI

ACİL SERVİS BOŞALTILDI DSÖ'den YENİ SALGIN UYARISI

DSÖ'den YENİ SALGIN UYARISI PROTEZ SONRASI BİSİKLET KULLANABİLİRSİNİZ

PROTEZ SONRASI BİSİKLET KULLANABİLİRSİNİZ ÇAY TİRYAKİLERİ AMAN DİKKAT

ÇAY TİRYAKİLERİ AMAN DİKKAT GENÇLERDE DE ARTIŞ GÖSTERİYOR

GENÇLERDE DE ARTIŞ GÖSTERİYOR KÜRESEL ÇAPTA HIZLA YAYILIYOR

KÜRESEL ÇAPTA HIZLA YAYILIYOR "TEŞHİS SÜRECİ YILLAR ALABİLİYOR"

"TEŞHİS SÜRECİ YILLAR ALABİLİYOR" DEMİR SOPALARLA SALDIRDILAR

DEMİR SOPALARLA SALDIRDILAR TAHLİYE İLE ORTAYA ÇIKAN SKANDAL

TAHLİYE İLE ORTAYA ÇIKAN SKANDAL PERU YANGIN YERİ

PERU YANGIN YERİ BİR 25 KASIM DAHA GEÇTİ...

BİR 25 KASIM DAHA GEÇTİ... ÖNCE ÖLDÜRDÜ, SONRA DA ÇÖPE ATTI

ÖNCE ÖLDÜRDÜ, SONRA DA ÇÖPE ATTI BU KEZ DE ESKİ SEVGİLİ DEHŞETİ

BU KEZ DE ESKİ SEVGİLİ DEHŞETİ CİLDİNİZİ YAZA HAZIRLAYIN

CİLDİNİZİ YAZA HAZIRLAYIN "GÖBEKLİTEPE'de KADIN İZLERİ"

"GÖBEKLİTEPE'de KADIN İZLERİ"  KADIN CİNAYETLERİ DURMUYOR

KADIN CİNAYETLERİ DURMUYOR KADINLAR BAKIRKÖY’de BULUŞTU

KADINLAR BAKIRKÖY’de BULUŞTU KAN DONDURAN DETAY

KAN DONDURAN DETAY F.BAHÇE AVRUPA'da ÇEYREK FİNALDE

F.BAHÇE AVRUPA'da ÇEYREK FİNALDE RİYAD'da BİR TEPKİ DE İTALYA'dan

RİYAD'da BİR TEPKİ DE İTALYA'dan ECZACIBAŞI 3. KEZ DÜNYA ŞAMPİYONU

ECZACIBAŞI 3. KEZ DÜNYA ŞAMPİYONU FİLENİN SULTANLARI FİNALDE

FİLENİN SULTANLARI FİNALDE PELE, SON YOLCULUĞUNA UĞURLANDI

PELE, SON YOLCULUĞUNA UĞURLANDI CHRİSTOPH DAUM KANSERE YAKALANDI

CHRİSTOPH DAUM KANSERE YAKALANDI FİLENİN SULTANLARI TAM GAZ

FİLENİN SULTANLARI TAM GAZ 3. KEZ DÜNYA ŞAMPİYONU OLDU

3. KEZ DÜNYA ŞAMPİYONU OLDU ALİ KOÇ ATEŞ PÜSKÜRDÜ...

ALİ KOÇ ATEŞ PÜSKÜRDÜ... İSTANBUL'da KANLI İNFAZ

İSTANBUL'da KANLI İNFAZ CANAVAR TEYZE İÇİN KARAR

CANAVAR TEYZE İÇİN KARAR YÜZÜNCÜYIL GAZETECİLER DERNEĞİ KURULDU

YÜZÜNCÜYIL GAZETECİLER DERNEĞİ KURULDU KATİL ZANLISI TEK TEK ANLATTI

KATİL ZANLISI TEK TEK ANLATTI SAHİL DEĞİL SANKİ CESET TARLASI

SAHİL DEĞİL SANKİ CESET TARLASI GÖKÇE'nin ÖLÜM NEDENİ KALP KRİZİ

GÖKÇE'nin ÖLÜM NEDENİ KALP KRİZİ MİNİK LEYLA CİNAYETİNDE YENİ GELİŞME

MİNİK LEYLA CİNAYETİNDE YENİ GELİŞME BUNUN ADI BARBARLIK

BUNUN ADI BARBARLIK İZMİR’de SİLAHLI ÇATIŞMA

İZMİR’de SİLAHLI ÇATIŞMA MUSTAFA DESTİCİ ÖZÜR DİLEDİ

MUSTAFA DESTİCİ ÖZÜR DİLEDİ KESİNTİNİN NEDENİ AÇIKLANDI

KESİNTİNİN NEDENİ AÇIKLANDI WHATSAPP, FACEBOOK ve INSTAGRAM ÇÖKTÜ

WHATSAPP, FACEBOOK ve INSTAGRAM ÇÖKTÜ "İLKELİ" DOĞAN MEDYA İRFAN DEĞİRMENCİ'Yİ KOVDU

"İLKELİ" DOĞAN MEDYA İRFAN DEĞİRMENCİ'Yİ KOVDU CAN ATAKLI RADYOCU da OLUYOR

CAN ATAKLI RADYOCU da OLUYOR İŞTE ULUSAL KANAL'ın YENİ GENEL YAYIN YÖNETMENİ

İŞTE ULUSAL KANAL'ın YENİ GENEL YAYIN YÖNETMENİ NAZLI ILICAK O KANALDAN KOVULDU

NAZLI ILICAK O KANALDAN KOVULDU DHA'nın AYLAN KURDİ FOTOĞRAFI TIME’ın "YILIN 100 FOTOĞRAFI-2015" ARASINDA

DHA'nın AYLAN KURDİ FOTOĞRAFI TIME’ın "YILIN 100 FOTOĞRAFI-2015" ARASINDA DOĞAN MEDYA'DA DEPREM

DOĞAN MEDYA'DA DEPREM VOLKAN KONAK'tan JET YANIT

VOLKAN KONAK'tan JET YANIT AYLA ALGAN SON VEDA

AYLA ALGAN SON VEDA VOLKAN KONAK'a SUÇ DUYURUSU

VOLKAN KONAK'a SUÇ DUYURUSU ÜNLÜ AKTÖR TRT DİZİSİNDEN AYRILDI

ÜNLÜ AKTÖR TRT DİZİSİNDEN AYRILDI MAHKEMEDEN SEREN SERENGİL KARARI

MAHKEMEDEN SEREN SERENGİL KARARI HADİSE ŞİKAYET ETTİ...

HADİSE ŞİKAYET ETTİ... ÜNLÜ MODACI TASARIMLARIYLA BÜYÜLÜYOR

ÜNLÜ MODACI TASARIMLARIYLA BÜYÜLÜYOR YARGI HAREKETE GEÇTİ

YARGI HAREKETE GEÇTİ  HAYRANINA NAKLEN ARABESK SÜRPRİZİ

HAYRANINA NAKLEN ARABESK SÜRPRİZİ NACİ GÖRÜR AÇIKLADI

NACİ GÖRÜR AÇIKLADI SAKİNE CANSIZ CİNAYETİNİN AYRINTILARI

SAKİNE CANSIZ CİNAYETİNİN AYRINTILARI GAZZE

GAZZE KIRIM NEDEN ÖNEMLİ

KIRIM NEDEN ÖNEMLİ